China registered a hefty bounce in polished diamond imports during the first six months of 2021, as the country brought the Covid-19 pandemic effectively under control, according to the Shanghai Diamond Exchange (SDE). The surge in trading provides the clarity that China’s diamond market is walking out of the haze of the pandemic and returning to a normal growth track, it noted.

From January through June 2021, diamond transactions at the SDE reached $3.821 billion, representing an 86.39% increase over the same period of 2019. SDE data shows that net polished imports reached $1.576 billion, already exceeding the annual import of 2020, and up 49.24% from H1 2019. With the current growth momentum, the annual diamond import in 2021 is on its way to significantly outperform 2019 and is highly likely to surpass the previous record high level in 2018 of $2.78 billion.

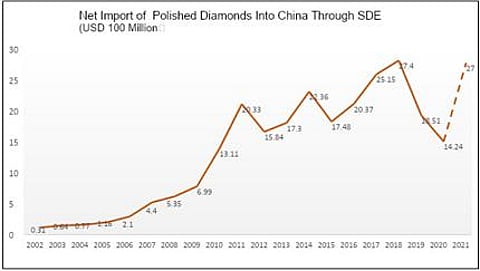

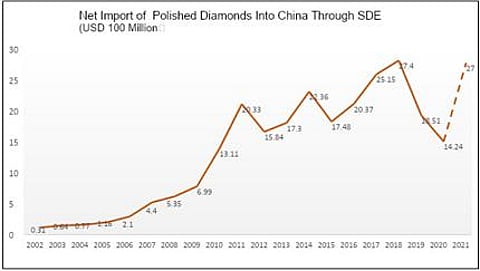

Since SDE was established in 2000, China’s diamond import has maintained an upward growth track, with a compound annual growth rate of 26% up to the historical high point in 2018.

Due to the double impact of the gloomy market sentiment in 2019 and the Covid-19 pandemic in 2020, China’s diamond import has dropped by nearly 50% in the past two years. The recent strong bounce indicates that China’s diamond market is still on solid footing to maintain a long-term spiral growth track as the fundamentals of macro-economy keep stable, SDE added.

China’s GDP grew by 18.3% in the first quarter of 2021, the country’s highest quarterly GDP growth rate in history. With increasing citizens’ incomes and maturing domestic market gains, the driving force of China’s economy has shifted from export and investment to consumption. In spite of the pandemic in 2020, consumption still contributed 54.3% to the total GDP growth of the year. As China’s economy is estimated to maintain 5-6% moderate growth rate in the coming future, the diamond market will be most likely to achieve another decade of desirable growth.

Lin Qiang, President of SDE and Vice-Chairman of WFDB, said, “The strong rebound of diamond import not only benefits from the quick recovery of the China’s economy, specifically the release of consumption power restrained by pandemic and appreciation of the RMB which offset the increase of diamond price in USD, but also results from the strategic move of anti-smuggle and anti-money laundering initiated by the Chinese government. With the support of the country’s special policies, Shanghai Diamond Exchange has provided a regularised channel for the diamonds imported into China and a platform to assist the Government to improve the supervision, which essentially safeguarded a healthy and sustainable growth of China’s diamond market in the past two decades.”

Chinese Customs authorities spearheaded a nation-wide campaign to crack down diamond smuggling in September 2020, involving RMB5.9 billion ($855 million) worth of goods. As a result, the carat weight and amount of diamonds imported through SDE and new membership applications surged, since it is China’s only gateway for importing diamonds under a favorable tax policy. The SDE has also posted a nearly 100% growth in rough diamond import under normal trade category from January to June 2021. The total number of SDE members increased to 382, of which 210 are foreign-funded companies.

With regard to the retail market, China’s diamond consumption has showed a localisation trend due to the limitations of international travel. According to Bain’s report, China’s diamond retail market is estimated to drop 6% in 2020, but will recover more rapidly than others.

In the fourth quarter of 2020, China’s diamond retail market achieved 15-20% growth as compared to 2019. From January to May 2021, China’s jewellery retail reached RMB128.3 billion, 68.4% up year-on-year over 2019, according to the data of China statistics bureau. The wedding market, once seriously affected by the pandemic, has also achieved quick recovery since the beginning of 2021. Over 2.1 million new couples registered for marriage certificates in the first quarter, 37% more than the same period of 2020. Based on the relevant data, China’s diamond retail market has returned to pre-pandemic level.

China registered a hefty bounce in polished diamond imports during the first six months of 2021, as the country brought the Covid-19 pandemic effectively under control, according to the Shanghai Diamond Exchange (SDE). The surge in trading provides the clarity that China’s diamond market is walking out of the haze of the pandemic and returning to a normal growth track, it noted.

From January through June 2021, diamond transactions at the SDE reached $3.821 billion, representing an 86.39% increase over the same period of 2019. SDE data shows that net polished imports reached $1.576 billion, already exceeding the annual import of 2020, and up 49.24% from H1 2019. With the current growth momentum, the annual diamond import in 2021 is on its way to significantly outperform 2019 and is highly likely to surpass the previous record high level in 2018 of $2.78 billion.

Since SDE was established in 2000, China’s diamond import has maintained an upward growth track, with a compound annual growth rate of 26% up to the historical high point in 2018.

Due to the double impact of the gloomy market sentiment in 2019 and the Covid-19 pandemic in 2020, China’s diamond import has dropped by nearly 50% in the past two years. The recent strong bounce indicates that China’s diamond market is still on solid footing to maintain a long-term spiral growth track as the fundamentals of macro-economy keep stable, SDE added.

China’s GDP grew by 18.3% in the first quarter of 2021, the country’s highest quarterly GDP growth rate in history. With increasing citizens’ incomes and maturing domestic market gains, the driving force of China’s economy has shifted from export and investment to consumption. In spite of the pandemic in 2020, consumption still contributed 54.3% to the total GDP growth of the year. As China’s economy is estimated to maintain 5-6% moderate growth rate in the coming future, the diamond market will be most likely to achieve another decade of desirable growth.

Lin Qiang, President of SDE and Vice-Chairman of WFDB, said, “The strong rebound of diamond import not only benefits from the quick recovery of the China’s economy, specifically the release of consumption power restrained by pandemic and appreciation of the RMB which offset the increase of diamond price in USD, but also results from the strategic move of anti-smuggle and anti-money laundering initiated by the Chinese government. With the support of the country’s special policies, Shanghai Diamond Exchange has provided a regularised channel for the diamonds imported into China and a platform to assist the Government to improve the supervision, which essentially safeguarded a healthy and sustainable growth of China’s diamond market in the past two decades.”

Chinese Customs authorities spearheaded a nation-wide campaign to crack down diamond smuggling in September 2020, involving RMB5.9 billion ($855 million) worth of goods. As a result, the carat weight and amount of diamonds imported through SDE and new membership applications surged, since it is China’s only gateway for importing diamonds under a favorable tax policy. The SDE has also posted a nearly 100% growth in rough diamond import under normal trade category from January to June 2021. The total number of SDE members increased to 382, of which 210 are foreign-funded companies.

With regard to the retail market, China’s diamond consumption has showed a localisation trend due to the limitations of international travel. According to Bain’s report, China’s diamond retail market is estimated to drop 6% in 2020, but will recover more rapidly than others.

In the fourth quarter of 2020, China’s diamond retail market achieved 15-20% growth as compared to 2019. From January to May 2021, China’s jewellery retail reached RMB128.3 billion, 68.4% up year-on-year over 2019, according to the data of China statistics bureau. The wedding market, once seriously affected by the pandemic, has also achieved quick recovery since the beginning of 2021. Over 2.1 million new couples registered for marriage certificates in the first quarter, 37% more than the same period of 2020. Based on the relevant data, China’s diamond retail market has returned to pre-pandemic level.

Follow DiamondWorld on Instagram: @diamondworldnet

Follow DiamondWorld on Twitter: @diamondworldnet

Follow DiamondWorld on Facebook: @diamondworldnet